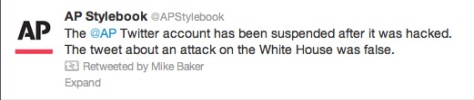

Buying a home can seem complicated and possibly too expensive for your taste, but its appeal is rooted in the fact that historically, houses increase in value over time, have tax benefits and put a roof over your head. Lisa Boaz, Mortgage Manager with West Community Credit Union, breaks down the basics of what you need to know about securing a mortgage.

What Does a Mortgage Lender Look for in a Borrower?

Getting pre-approved will make the whole process go more smoothly and make your offer more desirable to a seller. There are a few things that can affect pre-approval like your credit score, employment history and income, assets, and current debt-to-income ratio.

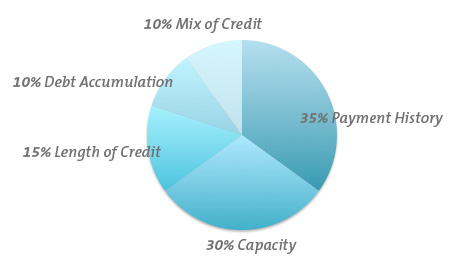

It’s important to maintain a good credit score since this is the primary way that lenders evaluate potential borrowers. If your credit report shows that you do not have a good credit history, talk to your lender. Not all credit issues will keep you from being pre-approved. Your lender can give you suggestions on how to re-establish credit. It is important to keep in mind, though, that adverse credit information may affect your interest rate.

Having a steady job will help you look more desirable to a lender. Typically, they will need to verify that you have two years of continuous employment and confirm your gross monthly income. There may be acceptable reasons why you have not been employed for the preferred period of time, so work with your lender to explain these gaps.

Once your loan information is approved, you will receive a pre-approval letter that is good for 90 days.

Current Debt and Monthly Obligations

Your credit report is also used to determine the amount of total monthly payments you currently have. Auto loans or leases, credit cards, personal loans, lines of credit and alimony/child support payments are taken into consideration. They are used to calculate your debt-to-income ratio by dividing your total monthly payments by your gross monthly income. Your lender must be assured that you can comfortably make all of your monthly payments so it is recommended that this number not exceed 45%. The amount of your mortgage payment will depend on how much you borrow, the term of the loan, the interest rate as well as taxes and insurance.

Private Mortgage Insurance (PMI) guarantees that the lender is paid off if the buyer defaults on a mortgage. This amount depends on the loan amount and the size of the down payment. The mortgage insurance premium is added to your monthly payment. A credit score of 680 or higher is required to qualify. If you put 20% down, you do not need PMI.

Types of Loan Programs

- Conventional – up to 97% loan to value (LTV). LTV is calculated by dividing the loan amount by the contract price. Any loan with an LTV higher than 80% requires PMI. There is no prepayment penalty and the remaining money needed to cover closing costs and prepaids can be gifted or serve as a seller’s credit.

- Federal Housing Administration (FHA) – 3.5% down payment required. Closing costs and prepaids can be gifted and/or a portion paid by the seller. Have your lender compare FHA to conventional to see what’s better for you.

- Veterans Administration (VA)

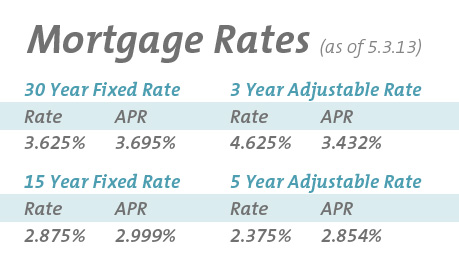

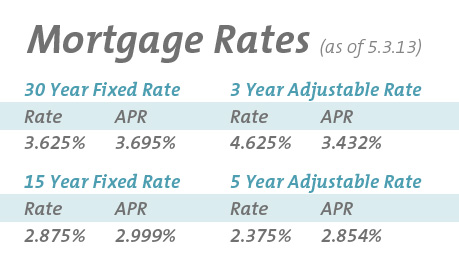

Fixed rate mortgages are popular because the rate stays fixed for the life of the loan. Only escrows (taxes and insurance) can change your payment. These are best for homebuyers who are counting on a predictable payment and plan to stay in the home for a long time.

The interest rates on adjustable rate mortgages will be fixed for a specific term then adjust annually based on future market conditions. Usually, ARMs have lower interest rates than fixed mortgages due to the borrower’s increased risk. The shorter the fixed period, the lower your rate.

ACTION PLAN

- Build up your credit and start saving for a down payment.

- Determine your price range.

- Find a reliable, reputable lender and get pre-approved.

- Select a real estate agent and begin your search for a home.

- Once you select a property, negotiate the contract and select a title company.

- After you close on the loan, move in!

Ready to start house hunting? Give Lisa Boaz a call at (636) 720-2495 for more detailed information about our mortgage loans or apply now.

Resources

How to Get a Mortgage in This Economy

Ten Things to Know About Mortgages

What to Know About Refinancing Your Mortgage